Key Takeaways

- Establish clear and realistic financial goals to guide investment decisions.

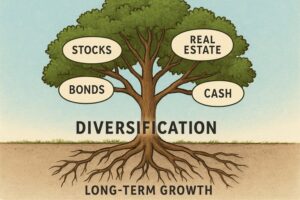

- Maintain a diversified portfolio to mitigate risk and enhance potential returns.

- Focus on long-term objectives rather than short-term market fluctuations.

- Regularly review and rebalance your portfolio to align with changing goals and market conditions.

Table of Contents

- Introduction

- Set Clear Financial Goals

- Diversify Your Portfolio

- Adopt a Long-Term Perspective

- Regularly Review and Rebalance

- Manage Costs and Taxes

- Stay Informed and Educated

Introduction

Building long-term wealth requires a disciplined approach, adherence to proven investment principles, and a willingness to look beyond short-term market movements. Investors like Jeff Van Harte have exemplified how adopting foundational strategies can lead to enduring financial growth. By establishing core decision-making and portfolio management guidelines, investors can navigate unpredictable markets with greater confidence and resilience.

Successful long-term investing isn’t about chasing fads or quick wins—it’s about setting clear intentions, minimizing unnecessary risks, and continually enhancing financial knowledge. Whether you aim to retire comfortably, support your family’s future, or achieve economic independence, following these principles will help you chart a sustainable path to meeting your objectives.

Set Clear Financial Goals

The journey to investment success begins with defining precise, actionable financial goals. Whether your target is a comfortable retirement, funding a child’s education, or making a significant purchase, your investment choices should reflect the timeline and magnitude of your objectives. Clearly articulated goals prevent haphazard decision-making and allow you to measure progress meaningfully. Effective goal setting translates into targeted investment plans, such as selecting accounts with tax advantages for retirement, or using 529 plans for education savings.

Tips for Effective Goal Setting

- Break down long-term goals into shorter milestones for better tracking.

- Be specific: define amounts, deadlines, and priorities for each goal.

- Adjust plans as life circumstances evolve—flexibility sustains motivation and relevancy.

Diversify Your Portfolio

Concentration in one investment can cause outsized losses if markets turn against you. Diversification—spreading your capital across various asset classes and sectors—remains the primary defense against risk. A balanced mix of stocks, bonds, cash equivalents, and alternative assets like real estate smooths out returns and bolsters portfolio resilience.

Benefits of Diversification

- Bonds cushion against stock market volatility.

- International assets counterbalance domestic market risks.

- Mixing growth and value stocks creates opportunities in varied market conditions.

According to Investopedia, diversification does not guarantee profits or protect against loss. Still, it dramatically reduces the risk of devastating downturns caused by a single point of failure within a portfolio.

Adopt a Long-Term Perspective

Markets are inherently volatile in the short run. Reacting emotionally to daily fluctuations often leads to poor decision-making—panic selling during downturns or exuberant buying during rallies. Historical market recoveries and the power of compounding returns over time exemplify the virtues of patience and discipline.

Why Long-Term Thinking Matters

- Compounding magnifies growth as returns generate their own returns.

- Staying invested helps you benefit from market rebounds after downturns.

- Reduces the impact of taxes and transaction costs from frequent trading.

A landmark study reviewed by Morningstar shows that avoiding market timing and remaining invested are far more rewarding than hopping in and out in response to news headlines.

Regularly Review and Rebalance

Portfolio allocations can drift as asset values change over time. Without regular reviews, a once-balanced portfolio could become riskier—or too conservative—than your original objectives. Rebalancing restores your strategy by selling portions of overperforming assets and buying underperformers.

How to Rebalance Effectively

- Schedule biannual or annual reviews to reassess allocation.

- Rebalance when asset classes veer beyond specific set percentages.

- Factor in transaction costs to avoid excessive trading.

Regular rebalancing maintains alignment with your risk profile and enforces the discipline of buying low and selling high, as suggested in resources like the Bogleheads Rebalancing Guide.

Manage Costs and Taxes

Excessive fees and taxes can silently erode your investment returns. Investors should be keenly aware of fund expense ratios, trading costs, and the impact of capital gains taxes when making investment decisions. Favoring low-cost index funds and exchange-traded funds (ETFs) can significantly increase net returns.

Tax-Efficient Investing Strategies

- Utilize tax-advantaged accounts like IRAs and 401(k)s.

- Consider tax-loss harvesting to offset capital gains.

- Favor long-term holdings over short-term trades to qualify for lower tax rates.

The Fidelity Viewpoints on After-Tax Returns outlines how a well-planned strategy can keep more money in your pocket through lower fees and tax-efficient account management.

Stay Informed and Educated

Financial markets evolve rapidly, and ongoing education ensures that your investment decisions are based on sound reasoning, not rumor or hype. Stay engaged with trustworthy news, balanced perspectives, and expert analyses. Ongoing learning helps you identify opportunities, spot risks, and adapt effectively as circumstances shift.

Resources for Lifelong Learning

- Follow reputable financial publications such as The Wall Street Journal and Financial Times.

- Participate in online investment forums and webinars for wider viewpoints.

- Consider professional advice for complex financial planning needs.

Adhering to these investment principles will guide investors through market volatility, help avoid common pitfalls, and build wealth over time. With clear goals, diversified portfolios, long-term discipline, cost mindfulness, and a commitment to ongoing education, anyone can take steps toward lasting financial well-being.